We have a problem here in the U.S. Well, to be clear, we have many problems. We have a billion problems. However, there’s one problem that has been haunting my dreams. The problem is that I have not been able to sleep at night since discovering the acronym. There is always so much talk in the political realm as to how to fix the U.S. economy. Before the Bernie bros and the socialists come in to say that dismantling Capitalism or Medicare for All is the way to go, let’s stay in reality and discuss the most boring thing for none-wonks: TAXES.

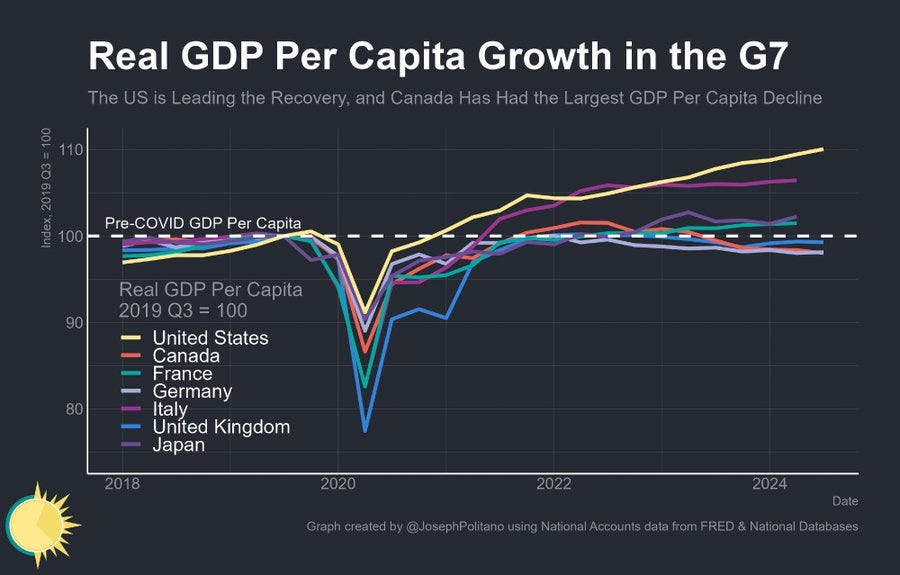

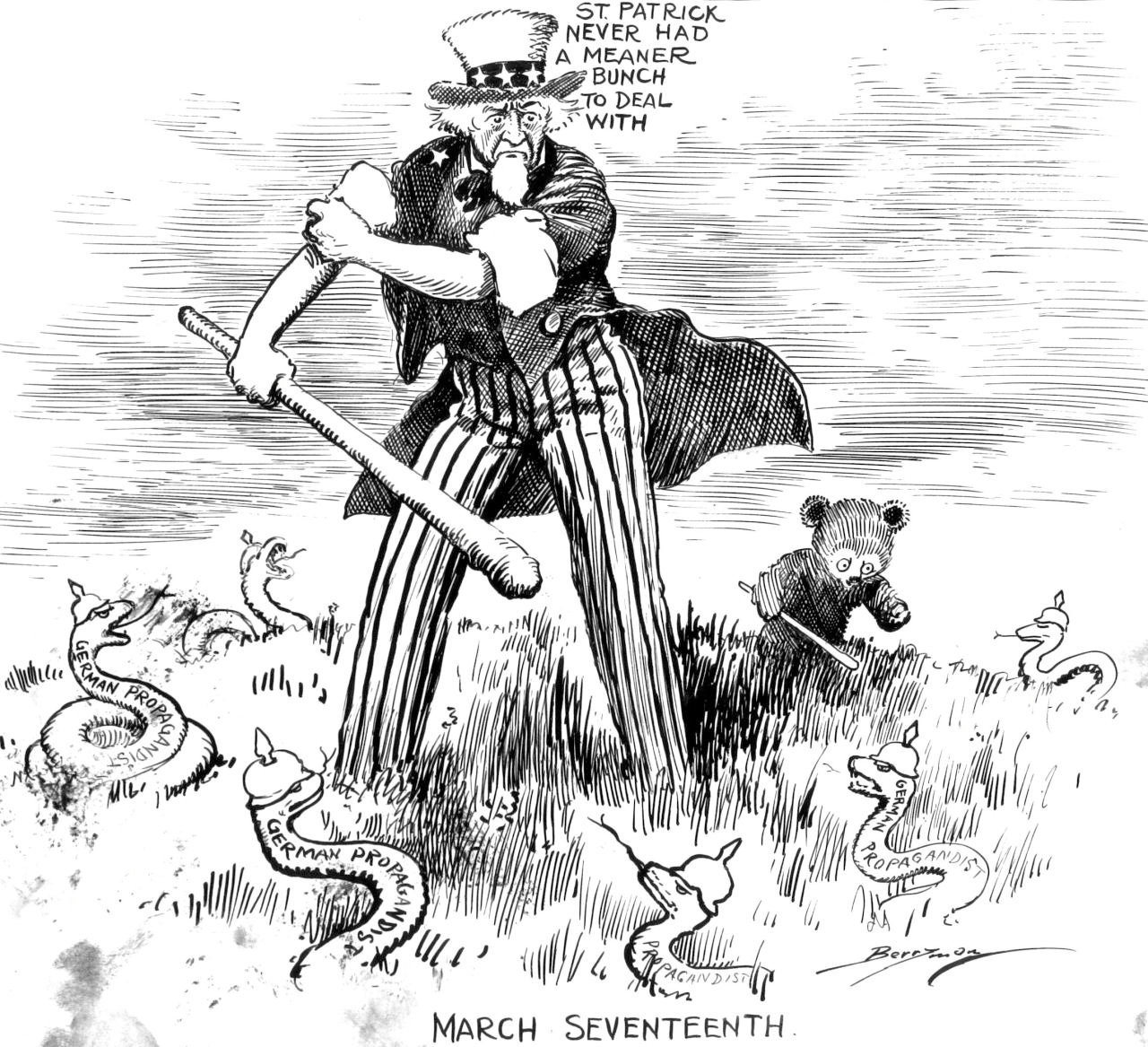

For decades, a flashing red warning light has been screaming that our economic engine is sputtering and our global standing is eroding faster than a sandcastle in a hurricane. We’re not just losing the race; we’re like an asthmatic chain smoker trying to run a marathon against genetically engineered cheetahs. Productivity growth, the lifeblood of a thriving economy, was stalling for nearly 20 years. It took ChatGPT, hybrid work, and a global pandemic to get the U.S. back on its feet. Please ignore the fact that the rest of the globe is stagnating; focus on the U.S. since we are the greatest nation on Earth. (and GDP growth supports that statement or at least the G7 post COVID)

Thanks for reading! Subscribe for free to receive new posts and support my work.

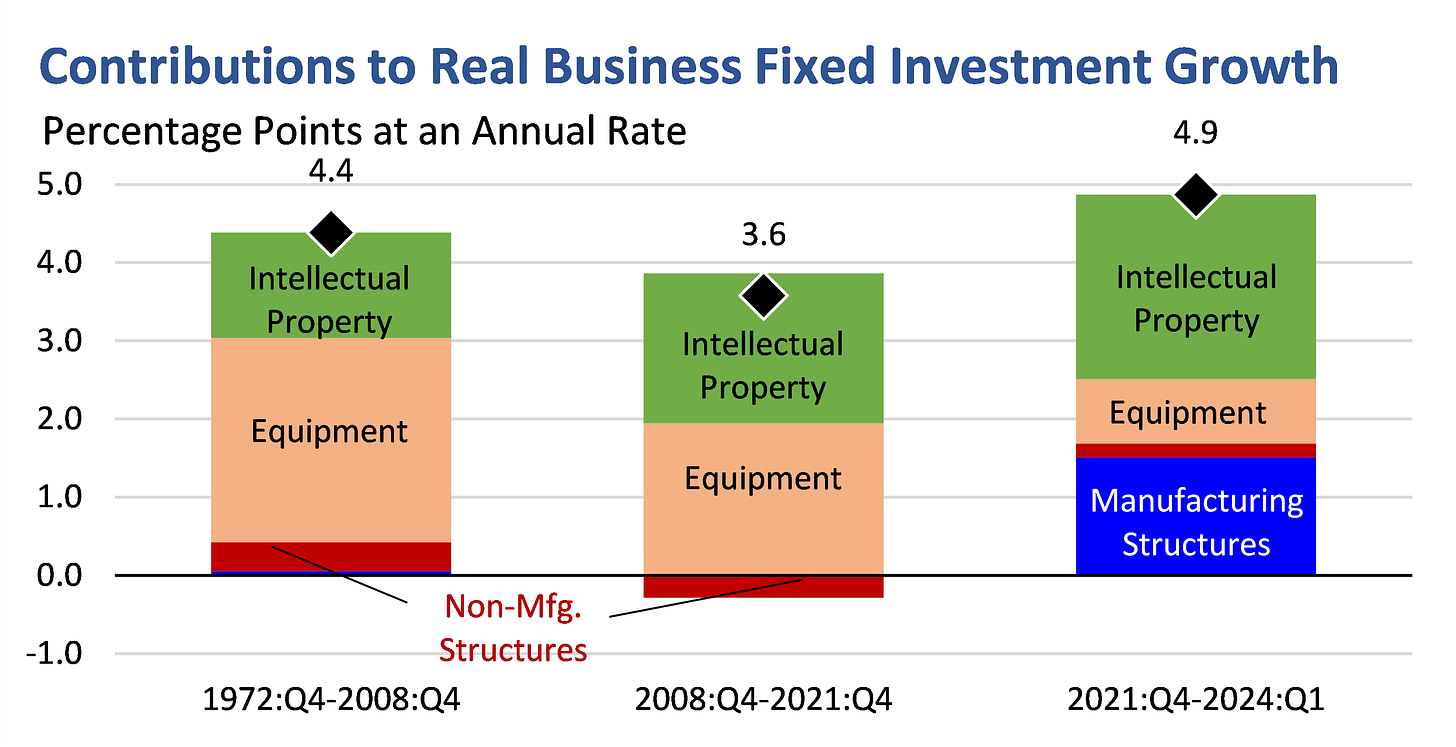

Investment has improved in recent years since President Biden’s massive industrial policies and the massive stimulus efforts post-COVID. Businesses are massively outperforming not only economic expectations and productivity goals but are also way beyond the expected investment rate. The U.S. treasury places this around 430$ over the expected investment. Look at that beautiful data from the U.S. treasury.

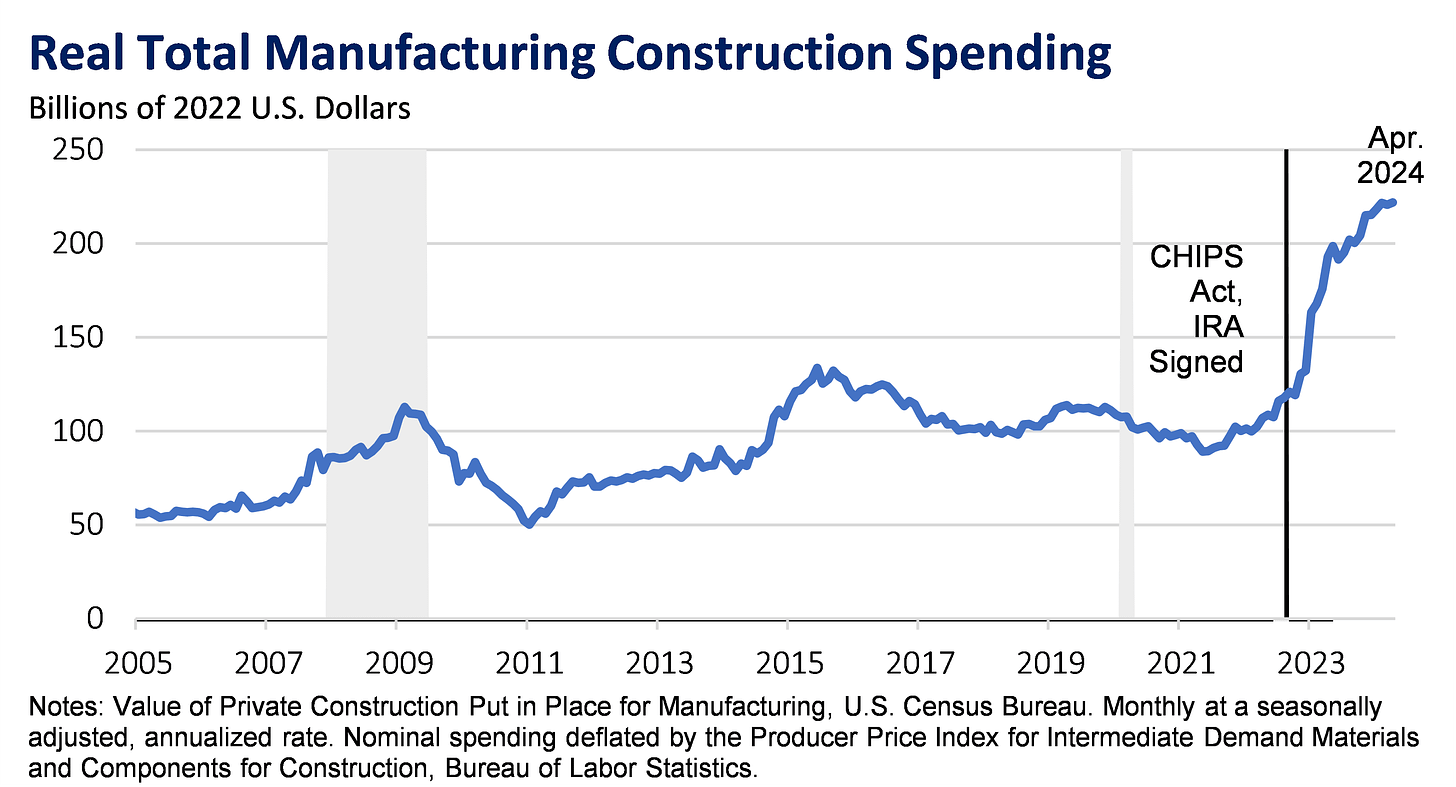

Look below at that beautiful, beautiful manufacturing construction money.

The fact of the matter is that the U.S. is booming. Things are good. People don’t feel it. Fuck all of that and stay on track with me here; remember, this is supposed to be about taxes! What if I told you there was a way to reasonably achieve some of the most lofty goals for our tax system? What if I told you there was a way to simplify corporate tax codes and find a way to prioritize U.S. exports AND boost economic growth all in one go? What if I told you that we could raise our federal revenues and bring back production and manufacturing to the United States while making it simpler for people to pay their taxes?

Our regulatory system is more tangled than a bowl of spaghetti after a toddler’s birthday party, a Gordian knot of red tape strangling innovation and progress. We can’t build a goddamned train line here without conducting 10,000 environmental reviews to protect disadvantaged bees that may or may not exist. We hold up our green energy transition in courts because people don’t want to look at windmills or battery storage near their homes. People demand cheaper rents and affordable housing but faint if an under-construction sign were to go up near their homes. While stuck in this self-inflicted quagmire, China is sprinting ahead, fueled by a potent cocktail of state-directed capitalism and strategic ambition. Those cheeky bastards at the CCP have no problem with their dirty economics, their state-directed overproduction to flood our markets—nuking our domestic industries. Their economy is expanding at an alarming rate. Frankly, it’s not just embarrassing; it’s a national security threat. Well, at least they WERE expanding at an alarming rate until 2022. Funnily enough, their concept of a slowdown is still incredible growth by our standards.

But fear not, people who had no friends in high school (wonk and tax policy aficionados!) There’s a cure, a potent economic elixir that can put hair back on Uncle Sam’s balding head, muscle back on his aging frame, and a steely glint back in his eye. It comes from two decisive yet often misunderstood measures: a Destination-Based Cash Flow Tax (DBCFT) and a machete-wielding approach to permitting reform. I’ll touch briefly on permitting reform (today’s post is above my love for DBCFT.)These aren’t just tweaks; they’re a radical economic detox and strategic rearmament, ready to propel us back to the forefront of global power and usher in an era of renewed American prosperity. It is time to embrace bold reforms that will change the trajectory of the U.S. economy. Did I forget to mention that it’s a bipartisan policy? Oh yeah, it’s just that good. Hey Siri, remember to include that DBCFT and Permitting reform are bipartisan policies and add bridging the national divide to the ‘pros’ list.

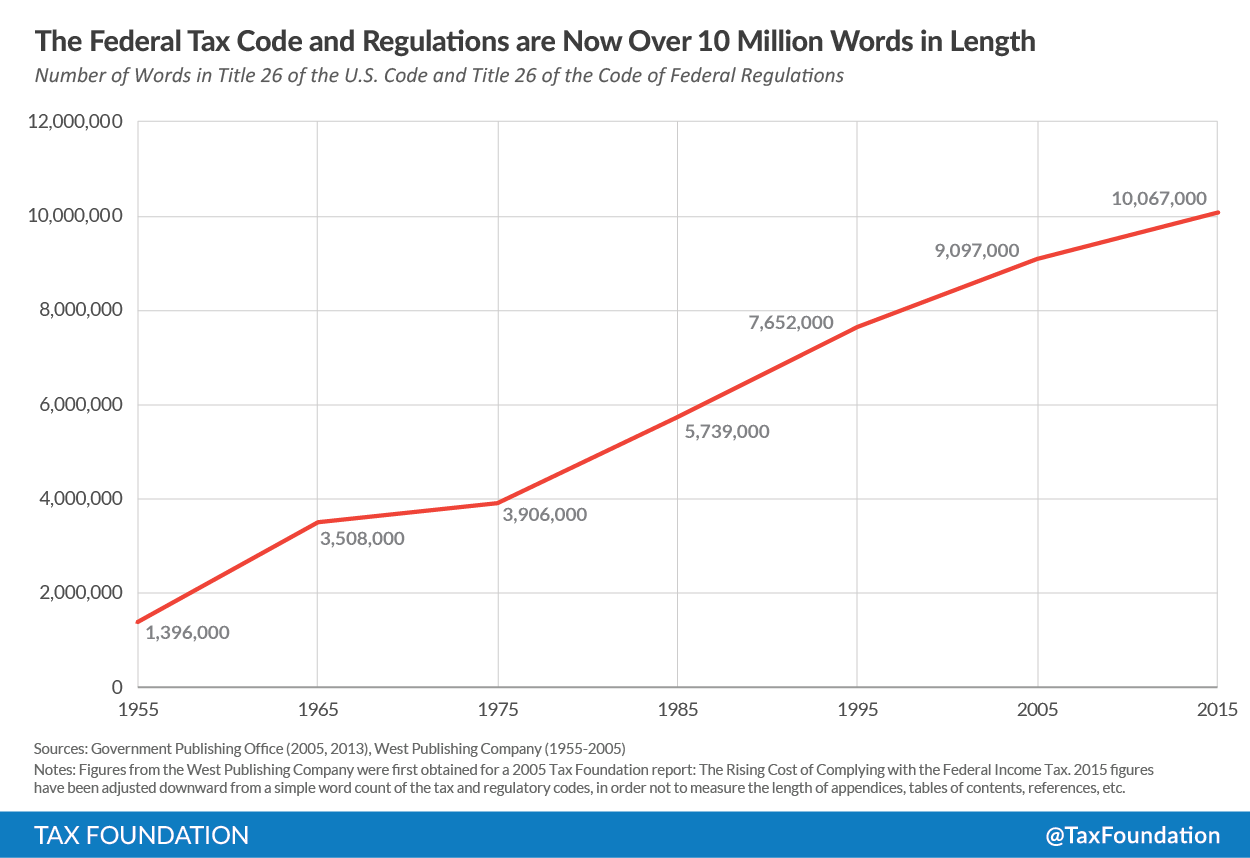

Our current corporate tax system is the economic equivalent of a haircut you had when you were 15 and rebelling against the world – outdated, unflattering, and desperately needing a makeover. It’s a relic of a bygone era, designed for a world no longer exists. It incentivizes accounting gymnastics to avoid taxes, often sending jobs, profits, and intellectual property overseas. It’s a system that rewards clever lawyers and offshore tax havens, not innovative businesses and American workers. And let’s be honest, it’s about as efficient as a one-legged dog trying to bury a shit out on your lawn a. The sheer complexity of our tax code is staggering. Just imagine a line graph showing the ever-increasing length and intricacy of the US tax code over time, a monstrous, convoluted beast compared to the elegant simplicity a DBCFT could offer.

Enter the DBCFT, the economic equivalent of a triple espresso shot, with geopolitical strategy and a garnish of fiscal responsibility. Isn’t that just a lovely combination? If none of those words mean anything to you, there’s still time to close out this post. (Sorry, Mom, you really don’t have to pretend to read this) This isn’t just about lowering taxes; it’s about fundamentally restructuring the system to incentivize investment, production, and job creation here in America. Here’s why it’s brilliant, vital in today’s world, and a potential goldmine for federal revenues:

Imagine a world where American companies aren’t penalized for selling their products here. With a DBCFT, imports are taxed, and exports are not. This not only levels the playing field against countries with Value Added Taxes (VATs) but also creates a powerful incentive to manufacture goods in the USA, reversing decades of offshoring and revitalizing our industrial heartland. We’re subsidizing exports and taxing imports, making American goods more competitive at home and abroad. It’s like finally showing up to a gunfight with more than just a butter knife, and it directly counters China’s export-driven strategy, which has long relied on undercutting American producers. The Tax Foundation estimates a DBCFT could boost U.S. GDP by 2.3% in the long run. That’s not just money; it’s factories, jobs, and a revitalized industrial heartland. While some fret about potential retaliation from trading partners, the reality is that many countries already employ similar mechanisms through their VAT systems. The DBCFT allows the US to compete more equally, promoting a more balanced global trade environment.

It is important to note that the Tax Foundation also found that consumer goods prices would rise, with some estimates as high as 8%. This is a real negative and something that needs to be taken seriously. However, there is the chance that with the increase in domestic manufacturing, those prices could eventually fall due to the rise in competition. Let’s weigh the cons before we try and sell you snake oil.

The Price Bogeyman

Let’s talk about the elephant in the room, the specter that haunts any discussion of a Destination-Based Cash Flow Tax (DBCFT): the threat of soaring consumer prices. It’s the go-to argument for opponents, the headline that sends shivers down the spines of everyday Americans. And yes, the Tax Foundation, a respected think tank, has indeed suggested that prices could rise by as much as 8% under a DBCFT. Sounds scary, right? A hefty price tag slapped onto everything from groceries to gadgets, all thanks to this radical new tax system. It’s enough to make anyone clutch their wallets and run for the hills. But before we panic and abandon the DBCFT ship, let’s take a deep breath and dissect this “price bogeyman.” When you look beyond the headline-grabbing figure and delve into the economic nuances, you’ll find that the reality is far more complex, and the fears are likely overblown.

First, it’s crucial to understand where that 8% figure comes from. It stems from economic models, specifically those used by the Tax Foundation, which often rely on “static analysis.” Think of it like taking a snapshot of the economy momentarily. These models assume that if you slap a tax on imports (a key part of the DBCFT’s border adjustment), the price of those imports will jump by the exact amount of the tax, and businesses will simply pass that entire cost onto consumers. But the economy isn’t a static snapshot; it’s a dynamic, ever-shifting movie. A DBCFT wouldn’t just change the price of imports; it would trigger a cascade of adjustments throughout the economy. Businesses would respond, consumers would adapt, and the dollar would likely react in ways that these static models don’t capture. The 8% figure becomes more like a worst-case scenario, a theoretical upper limit if you will, rather than a realistic prediction.

One of the most significant dynamic adjustments would be in the value of the U.S. dollar. By making the U.S. a more attractive place to invest and boosting exports, the DBCFT would likely increase demand for the dollar on the global market. A stronger dollar means imports become cheaper, even with the border adjustment tax. Think of it like this: if the dollar gets 10% stronger, and the border adjustment tax is 10%, those two effects cancel each other out for imported goods. Consumers wouldn’t see any price increase at all on those items. The exact magnitude of this “exchange rate effect” is hotly debated among economists. Some studies suggest a substantial appreciation of the dollar, potentially neutralizing a large portion of the impact of border adjustment on prices. But even a modest appreciation would significantly soften the blow.

But the dynamic shifts don’t stop with exchange rates. The DBCFT is specifically designed to incentivize companies to move production back to the United States. As factories are built, jobs are created, and American-made goods become more abundant, something magical happens: competition increases. When companies are vying for your dollars, they’re forced to keep prices in check. Fueled by the reshoring wave, this increased domestic competition would put downward pressure on prices over time. While there might be an initial price bump as the border adjustment kicks in, this would likely be a temporary blip. As American industries scale up and become more efficient, prices could stabilize or fall below pre-DBCFT levels in some sectors.

(that’s correct, FALL BELOW)

We also can’t ignore the other side of the economic coin: wages and growth. The DBCFT is projected to unleash a torrent of investment in new technologies, equipment, and worker training. This would boost productivity, meaning businesses could produce more with less, further dampening price pressures. More importantly, a more productive economy with increased investment translates into higher labor demand, which means higher wages for American workers. If your paycheck gets a boost thanks to the DBCFT, a slight increase in the price of some goods becomes much more manageable. And let’s not forget the cost of doing nothing. Sticking with our current broken tax system means continuing to hemorrhage jobs, investment, and economic competitiveness to countries with more favorable tax policies. It means a future of slower growth, lower wages, and a diminished role for America on the global stage. When you weigh those long-term costs against the possibility of a temporary and likely modest price increase under a DBCFT, the choice becomes much clearer. Think ripping off a band-aid instead of ripping the band-aid cures your brain cancer.

Look, any significant economic reform carries risks. And yes, there’s a chance that prices could tick up initially under a DBCFT. But to focus solely on that possibility, to let the fear of a potential 8% price increase (which, again, is likely an overestimate) paralyze us, is to miss the forest for the trees. The DBCFT offers a path to a more dynamic, prosperous, and secure American economy. It’s a chance to revitalize our manufacturing sector, boost wages, and reclaim our position as a global economic leader. It’s a bold move, yes, but these are times that demand boldness. So, let’s ditch the fearmongering and the simplistic analyses. Let’s have an honest conversation about the DBCFT, one that acknowledges the complexities, weighs the potential costs against the enormous benefits, and recognizes that the biggest risk of all is sticking with a status quo that’s slowly but surely eroding America’s economic future. The price of inaction, after all, is far higher than any temporary bump in the cost of goods. It’s time to choose a future of growth and renewed American dominance, and the DBCFT is a crucial step in that direction.

In the race for global economic dominance, America needs every advantage it can get. We need a tax system that’s not just fair but also innovative, unleashing American businesses’ full potential to innovate, invest, and create jobs. That’s where a Destination-Based Cash Flow Tax (DBCFT) comes in, and one of its most powerful components is immediate expensing.

Think of immediate expensing as removing the ankle weights from American businesses, freeing them to sprint ahead in the global marketplace. It’s a simple yet revolutionary concept: Let companies deduct the full cost of their capital investments – new equipment, machinery, factories, research facilities – in the same year they make those investments. Sounds too good to be true? It’s a key ingredient in the recipe for robust economic growth, and here’s why:

Our current tax system forces businesses to depreciate their capital investments over many years, sometimes decades. This means they can only deduct a small portion of the cost each year, spreading the tax benefit over a long period. It’s like telling a company, “Yes, you can invest in that new, productivity-boosting machine, but we’re going to make you wait years to realize the tax benefits of that investment fully.”This system creates a significant disincentive to invest. Businesses, like all of us, prefer to have money in their pockets now rather than later. The time value of money is a fundamental principle of finance. A dollar today is worth more than a dollar tomorrow. Depreciation schedules ignore this principle, effectively penalizing companies for investing in their future and, by extension, America’s future.

On the other hand, immediate expensing recognizes the time value of money and supercharges investment. Allowing businesses to deduct the full cost of their investments immediately dramatically reduces the “cost” of those investments from a tax perspective. This frees up capital that companies can then use to invest even more, creating a powerful virtuous cycle.

Imagine a company considering building a new factory. Under the current system, they might hesitate because of the long depreciation schedule. They’d have to wait years to fully recoup the tax benefits of their investment, making the project less financially attractive. However, with immediate expensing, they can deduct the entire cost of the factory in the first year, making the investment much more appealing. They build the factory, hire workers, purchase equipment, and boost production – all thanks to the power of immediate expensing—the benefits of immediate expensing ripple throughout the economy. The Tax Foundation, hardly a bastion of radical economic ideas, estimates that a DBCFT with immediate expensing would increase the U.S. capital stock by a whopping 6.9%.

Businesses would have a powerful incentive to build new facilities, upgrade their equipment, and invest in cutting-edge technologies. This means more state-of-the-art factories, efficient machinery, and a more productive economy overall. Building and operating these new factories and deploying these advanced technologies requires skilled workers. Immediate expensing would fuel demand for high-paying jobs in manufacturing, engineering, research, and other high-value sectors, helping to rebuild the American middle class. New, more efficient equipment and technologies make workers more productive. They can produce more goods and services with the same effort, leading to lower costs, higher wages, and a higher standard of living for all Americans.

Immediate expensing isn’t just about building more of the same but building the future. Reducing the cost of investing in research and development encourages companies to take risks, experiment with new ideas, and develop the breakthrough technologies that will define the 21st century. This is particularly important when there is a desire to grow new industries that require large amounts of capital. This surge in investment has a powerful multiplier effect throughout the economy. As businesses invest and expand, they create demand for goods and services from other companies. This increased demand ripples outwards, creating jobs and boosting incomes across various industries, further fueling economic growth.

In today’s globalized economy, we can’t afford to disadvantage our businesses. China, our biggest economic competitor, understands the power of investment-friendly tax policies. They use various tools, including generous tax incentives and massive state subsidies, to boost their domestic industries and challenge American dominance. Sticking with our outdated depreciation system while China aggressively incentivizes investment is like bringing a knife to a gunfight. Immediate expensing, as part of a broader DBCFT, helps to level the playing field, giving American businesses a fighting chance to compete and win in the global marketplace.

“Keep It Simple, Stupid” – the KISS principle. It’s a design philosophy that champions clarity and ease of use over needless complexity. And nowhere is this principle more desperately needed than in our byzantine, labyrinthine, utterly bewildering U.S. tax code. Today, our tax system is the antithesis of KISS. It’s a monstrous, ever-growing tangle of rules, regulations, deductions, credits, and loopholes that even seasoned tax professionals struggle to navigate. It’s a system that breeds inefficiency, rewards clever accounting tricks, and punishes honest businesses trying to do the right thing. But what if there was a better way? What if we could replace this convoluted mess with a tax system that’s simple?

That’s the promise of the Destination-Based Cash Flow Tax (DBCFT), and its simplicity is not just a minor perk; it’s a fundamental game-changer that could unleash a wave of American innovation and economic growth. Our current tax code is estimated to be millions of words long, a constantly shifting landscape of rules that requires businesses to spend billions of dollars each year on compliance. Imagine that: billions of dollars that could be going towards research and development, new equipment, or hiring more workers are instead being poured into deciphering a tax code that seems designed to be incomprehensible.

This complexity doesn’t just waste money; it wastes time and talent. Instead of focusing on creating innovative products, improving services, and expanding their businesses, entrepreneurs and business owners are forced to become amateur tax experts or, worse, hire armies of lawyers and accountants to navigate the maze for them

This is particularly crippling for small businesses and startups, the very engines of American innovation. They often lack the resources to compete with large corporations that can afford to exploit every loophole and deduction. The complexity of the tax code creates an uneven playing field, tilting it in favor of established players and stifling the entrepreneurial energy that drives economic growth.

The DBCFT, in contrast, is a model of simplicity. Focusing on cash flow – money coming in and money going out – eliminates the need for many of the complex provisions plaguing our current system. No more depreciation schedules, complex inventory accounting, or convoluted rules for foreign income.

Imagine a tax system where you can calculate your tax liability on a single page, without needing a law degree or a team of high-priced accountants. That’s the beauty of the DBCFT. It’s a system that’s easy to understand, easy to comply with, and easy to enforce. This newfound simplicity would have profound effects:

- Reduced Compliance Costs: Businesses would save billions of dollars annually on tax preparation and compliance. This freed-up capital could be reinvested in growth, creating jobs and boosting wages.

- Increased Transparency: A simpler tax system is a more transparent tax system. It’s harder to hide income or engage in shady accounting practices when the rules are clear and easy to understand.

- A Level Playing Field: Small businesses and startups would be able to compete more effectively with larger corporations. They could focus on their core competencies – innovation and creating value – rather than getting bogged down in tax complexities.

- An Entrepreneurial Surge: By making it easier to start and run a business, the DBCFT would unleash a wave of entrepreneurial energy. More Americans would be empowered to pursue their business dreams, leading to a more dynamic and innovative economy.

The simplicity of the DBCFT also represents a fundamental shift in mindset. Our current system incentivizes businesses to focus on minimizing their tax liability, often through complex and sometimes dubious means. It rewards accounting gymnastics, not genuine value creation.

The DBCFT, on the other hand, aligns businesses’ interests with the nation’s interests. By focusing on cash flow and incentivizing investment, it encourages companies to grow, innovate, and create jobs—activities that benefit both the businesses themselves and the broader economy.

Let’s talk about two things Americans like me love to dream about: a government flush with cash to fund essential services and a lower cost of living that leaves more money in their pockets. These might seem like opposing forces. One might imagine that higher revenue collection could come at a cost to the taxpayer, but what if I told you there’s a plan that could potentially achieve both? Enter the Destination-Based Cash Flow Tax (DBCFT), a policy that’s not just about changing how we tax corporations, but about fundamentally reshaping our economy for the better.

For too long, our tax system has been a leaky bucket, riddled with loopholes, জটিল exemptions, and opportunities for multinational corporations to shift profits overseas, leaving the U.S. Treasury with less revenue than it should rightfully collect. At the same time, many American families struggle with a cost of living that feels increasingly out of reach. The DBCFT, especially when paired with smart permitting reform, offers a bold solution to both of these challenges: a potential revenue revolution that could also pave the way for a more affordable future.

The current corporate tax system is like an old, sputtering engine – inefficient, outdated, and in desperate need of an overhaul. It allows, and in some ways even encourages, corporations to engage in complex accounting maneuvers to minimize their tax liabilities. The result? Billions of dollars in potential tax revenue that slip through the cracks, leaving the burden on individuals and small businesses.

The DBCFT, on the other hand, is designed to be a revenue-generating powerhouse. Here’s how:

Instead of focusing solely on corporate profits, which are notoriously easy to manipulate and shift across borders, the DBCFT casts a wider net by taxing consumption. This means it captures revenue from a larger portion of economic activity, including goods that are produced overseas but consumed here in the United States. Think of it like this: every time someone buys a product, regardless of where it was made, a portion of that sale contributes to the U.S. Treasury under a DBCFT. This is particularly crucial in our globalized economy, where multinational corporations can easily shift profits to low-tax jurisdictions while still selling their products to American consumers. The border adjustment mechanism is key here – it ensures that imports are taxed, leveling the playing field for American businesses and ensuring that everyone contributes their fair share to the tax base.

The sheer complexity of our current tax code is an invitation for tax avoidance. Corporations employ armies of lawyers and accountants to exploit every loophole, deduction, and credit available. The DBCFT, with its streamlined, cash-flow-based approach, eliminates many of these loopholes, making it much harder to engage in complex tax avoidance schemes. With fewer opportunities for accounting gymnastics, more revenue flows directly into the Treasury. This is not just about fairness; it’s about efficiency. A simpler system is easier and cheaper to administer, meaning the IRS can focus on collecting the taxes that are actually owed, rather than getting bogged down in endless audits and disputes.

As we’ve discussed in previous sections, the DBCFT is designed to be a catalyst for economic growth. By incentivizing investment, boosting domestic production, and creating jobs, it sets off a virtuous cycle. More economic activity means higher incomes, more spending, and ultimately, higher tax revenues across the board – from corporate taxes, income taxes, payroll taxes, and sales taxes. It’s a rising tide that lifts all boats, including the government’s fiscal position. A growing economy generates more revenue organically, without the need for higher tax rates.

The Potential for a Lower Cost of Living: A Counterintuitive Benefit?

Now, you might be thinking: “Okay, more revenue for the government is great, but how does that help me? Won’t a tax on imports just make everything more expensive?” This is a valid concern, and one that we addressed in a previous post about potential price increases. However, it is also an incomplete picture of the overall macroeconomic effects of a DBCFT. While there might be a temporary uptick in the prices of some imported goods due to the border adjustment, several factors could contribute to a lower cost of living over the long term:

As the DBCFT incentivizes companies to reshore production and invest in the U.S., we’ll see more goods produced domestically. This increased supply, coupled with enhanced competition among American businesses, will put downward pressure on prices. Goods made in America don’t need to be shipped across vast oceans, reducing transportation costs and making them potentially more affordable. Moreover, a robust domestic manufacturing base makes our supply chains more resilient to global shocks, like pandemics or geopolitical instability. This means fewer price spikes caused by supply chain disruptions, leading to more stable and predictable prices for consumers. The investment boom spurred by the DBCFT is projected to increase demand for labor, leading to higher wages for American workers. This increased purchasing power can help offset any potential price increases and improve overall living standards.

The Combined Power of DBCFT and Permitting Reform

It’s important to remember that the DBCFT is not a silver bullet. Its effectiveness in generating revenue and potentially lowering the cost of living is significantly enhanced when coupled with other pro-growth policies, particularly permitting reform.

A streamlined permitting process that allows businesses to build new factories, develop energy resources, and expand infrastructure quickly and efficiently is essential to realizing the full benefits of the DBCFT. By removing regulatory bottlenecks, we can accelerate the reshoring of manufacturing, boost domestic production, and create the conditions for a genuinely competitive and dynamic economy. Better yet, coupled with effective competition measures against China, the U.S. Renaissance is within sight.

For decades, America has operated under the assumption that free trade and globalization would inevitably lead to a more peaceful and prosperous world. We opened our markets, embraced international cooperation, and believed that economic interdependence would make war unthinkable. But the world has changed. We now find ourselves in a new era of great power competition, and the goddamn challenger to American dominance is a rising China that doesn’t play by the same rules.

This isn’t just about economics; it’s about national security, our global leadership, and the future of the international order. It is time to acknowledge that China’s economic model, built on a foundation of unfair trade practices, massive state subsidies, and a blatant disregard for intellectual property rights, poses a direct threat to American power and influence. Their model is designed to undercut American businesses, dominate strategic industries, and ultimately displace the United States as the world’s leading economic and military power.

The evidence of China’s strategic intent is staring us in the face. Consider the manufacturing sector, once the bedrock of American economic might. China, through a combination of state-directed capitalism, currency manipulation, and unfair trade practices, has hollowed out American manufacturing, leaving us increasingly reliant on Chinese imports, even for strategically vital goods.

The DBCFT, with its border adjustment mechanism, is a powerful tool to counter China’s economic aggression. It’s not about protectionism; it’s about leveling the playing field and refusing to play by rules designed to put American businesses and workers at a disadvantage.

Here’s how it works as a strategic weapon:

The border adjustment effectively neutralizes the advantage that China gains from its Value Added Tax (VAT) system, which rebates taxes on exports while imposing them on imports. By taxing imports and exempting exports, the DBCFT creates a more level playing field for American companies, both at home and abroad. It sends a clear message: we will no longer tolerate unfair trade practices that undermine our industries and threaten our economic security.

By incentivizing domestic production, the DBCFT can help us reclaim lost ground in strategically important sectors like semiconductors, pharmaceuticals, and renewable energy. This reduces our dangerous dependence on China for these critical goods, strengthening our supply chains and enhancing our national security. Imagine a future where we’re not reliant on a potential adversary for essential medicines or the microchips that power our military technology. The DBCFT’s focus on investment and immediate expensing will fuel a new wave of American innovation. By making it more attractive to invest in research and development, we can ensure that the technologies of the future are developed here in the United States, not in China. This is crucial not just for our economic competitiveness but also for maintaining our technological edge in areas critical to national defense.

Implementing a DBCFT sends a powerful message to China and the rest of the world: America is no longer willing to be taken advantage of. We will defend our economic interests and compete vigorously in the global marketplace. This is not about isolationism; it’s about asserting our economic sovereignty and protecting our national security in a world where not everyone plays fair. This isn’t just a debate about tax policy; it’s a debate about the kind of world we want to live in. Do we want a world where America remains the leading economic and military power, capable of defending its interests and promoting its values? Or do we want a world where China sets the rules, dominates strategic industries, and dictates the terms of global engagement?

The DBCFT is not a panacea, but it is a crucial step towards securing America’s economic future and strengthening our national security in this new era of great power competition. It’s a tool that can help us rebuild our industrial base, promote innovation, and counter the unfair trade practices that threaten our prosperity and our global leadership. It is time to stop playing defense and start playing offense. It is time to embrace bold policies that will ensure America’s economic and strategic dominance for generations to come. The DBCFT is more than just a tax reform; it’s an economic weapon, a statement of national resolve, and a crucial investment in a future where America remains a beacon of freedom, prosperity, and strength.

While some may argue that a DBCFT could lead to higher prices for imported goods, the reality is that the combination of increased domestic production, enhanced competition, and a more efficient supply chain could actually lead to a lower cost of living over time. As American companies bring production home, they’ll create more competition in the domestic market. This increased competition will put downward pressure on prices, benefiting consumers. Goods produced domestically don’t have to be shipped halfway around the world, reducing transportation costs and making them more affordable. A more robust domestic manufacturing base will make our supply chains more resilient to global shocks, reducing the risk of price spikes caused by disruptions like pandemics or geopolitical instability. This means more stable prices and less economic turmoil for American families.

A DBCFT and permitting reform are not just good policies; they’re a political slam dunk waiting to happen. They offer a chance to build a broad coalition of businesses, labor unions, and everyday Americans who want a stronger, more prosperous country. This country can stand up to China and reclaim its position as the world’s economic leader. A recent Coalition for a Prosperous America poll found that 71% of Americans favor policies that would boost domestic manufacturing, even if it means higher prices. This shows the public’s appetite for bold action, a return to American economic strength, and a future where our children and grandchildren can enjoy the same prosperity that previous generations took for granted. This shows the public’s appetite for bold action.

The Whining Will Be Sensational, But We Can Handle It

Of course, the lobbyists and special interests will scream bloody murder. The defenders of the status quo, the beneficiaries of a broken system, will fight tooth and nail to protect their privileges. They’ll say a DBCFT is “protectionist” or “radical.” They’ll claim that streamlining permitting will destroy the environment, unleashing a torrent of pollution and endangering endangered species. But let’s be real: they’re just protecting their gravy train and the status quo that benefits them, not America. Their arguments are a smokescreen designed to obscure the truth: that our current system is failing us and that bold reforms are needed to secure our future.

The truth is a DBCFT is about making our tax system fairer, more efficient, and more competitive on the global stage. Permitting reform is about common sense and getting things done, about building the infrastructure we need for a prosperous 21st-century economy. It’s about putting America first, not special interests or foreign competitors. It is about restoring America’s economic might.

We can continue down the path of slow growth, regulatory paralysis, and declining competitiveness, a path that leads to a future where America is a second-rate power, relegated to the sidelines of history. Or we can embrace bold reforms that will unleash American ingenuity, create jobs, secure our supply chains, and restore our economic and geopolitical leadership. This is not just about economics, it is about reclaiming our national destiny.

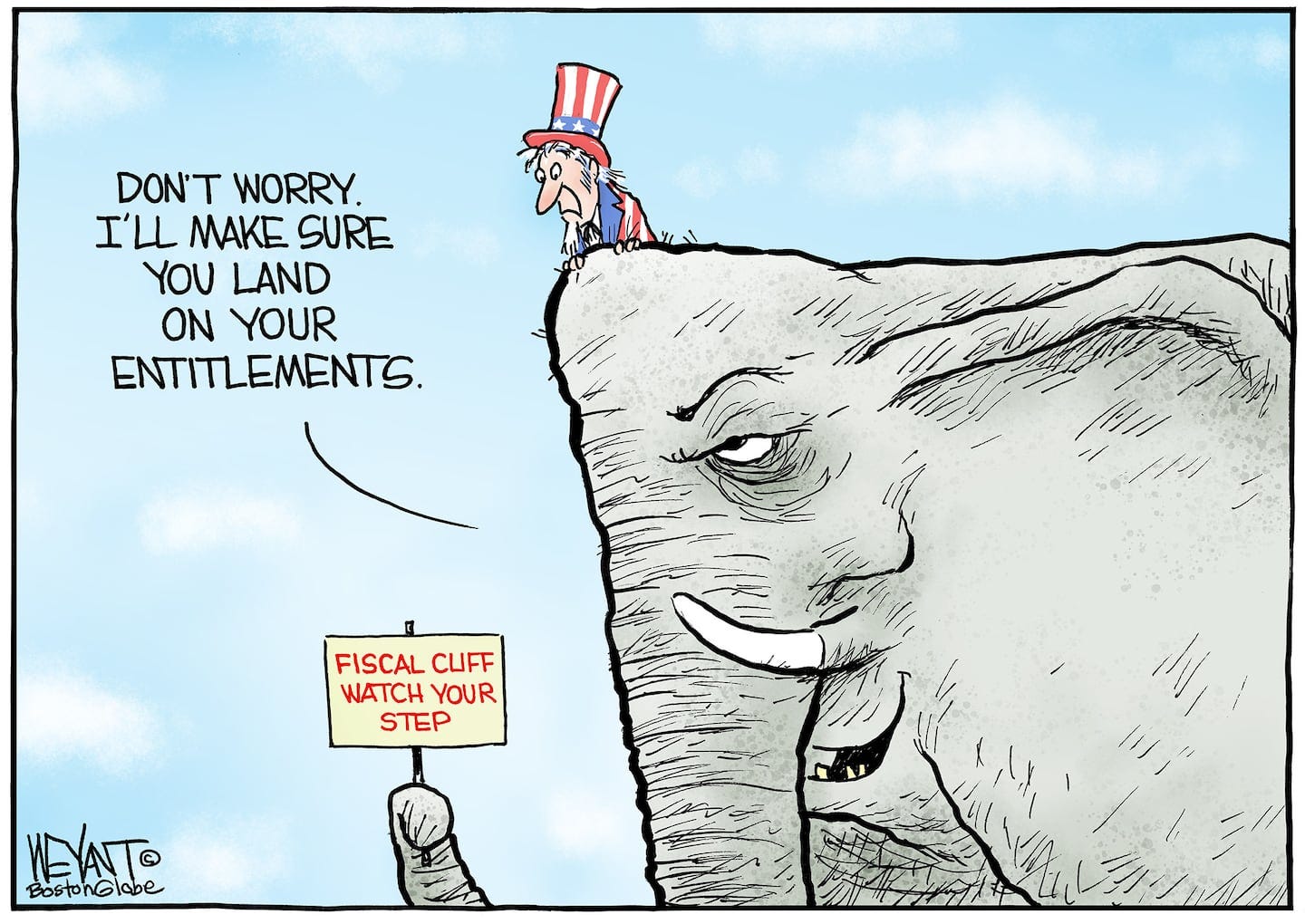

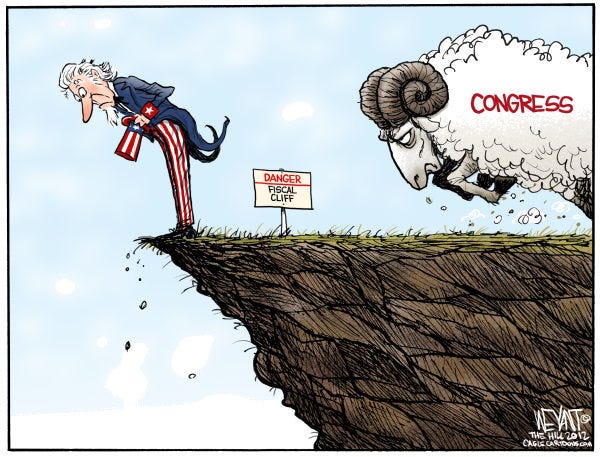

2025 and the Fiscal. Time for Change.

The year 2025 looms large on the American political and economic horizon. It’s not just another year; it marks a critical juncture, a fiscal cliffhanger that will force Congress to confront fundamental questions about taxes, spending, and the future of the American economy. This is the year when many of the provisions of the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire, triggering automatic tax increases for individuals and businesses unless Congress acts. This looming deadline creates both a challenge and a unique opportunity to rethink our tax system, and it’s within this context that the Destination-Based Cash Flow Tax (DBCFT) emerges as a potentially game-changing solution.

The 2017 TCJA was a landmark piece of legislation that significantly reduced individual and corporate income tax rates. However, to comply with Senate budget rules and avoid a Democratic filibuster, Republicans designed many of the act’s key provisions, particularly the individual income tax cuts, to expire at the end of 2025.

The TCJA lowered individual income tax rates across the board, expanded the standard deduction, and doubled the child tax credit. Come 2026, these provisions are scheduled to revert to their pre-2017 levels, resulting in a significant tax increase for most Americans. The TCJA created a new deduction for income from pass-through businesses (sole proprietorships, partnerships, and S-corporations). This provision, which significantly reduced the tax burden on many small and medium-sized businesses, is also set to expire.The TCJA doubled the estate and gift tax exemption, meaning fewer estates would be subject to the tax. This change, too, will sunset in 2025. The TCJA capped the deduction for state and local taxes at $10,000, a provision that disproportionately affected residents of high-tax states. This cap is also scheduled to expire.

The expiration of these provisions creates a “fiscal cliff” because it represents a sudden and significant contraction in fiscal policy. Unless Congress acts, taxes will automatically go up, potentially dampening consumer spending and economic growth. This creates a political imperative for Congress to do something, but the question is what?

Navigating the 2025 fiscal cliff would be a daunting task even in the best of times. But in today’s hyper-partisan political climate, it’s akin to navigating a minefield while blindfolded. Democrats and Republicans have fundamentally different views on taxes, spending, and the role of government, making compromise extremely difficult.

Republicans generally favor lower taxes and smaller government. They are likely to push for making the TCJA’s individual income tax cuts permanent, arguing that this will stimulate economic growth. They may also seek to further reduce corporate taxes, although the TCJA already brought the corporate rate down to 21%. Democrats, on the other hand, are generally more supportive of using the tax code to address income inequality and fund social programs. They are likely to oppose making the TCJA’s individual tax cuts permanent, particularly for higher earners, arguing that they disproportionately benefited the wealthy. They may also push for raising taxes on corporations and high-income individuals to fund investments in areas like healthcare, education, and climate change.

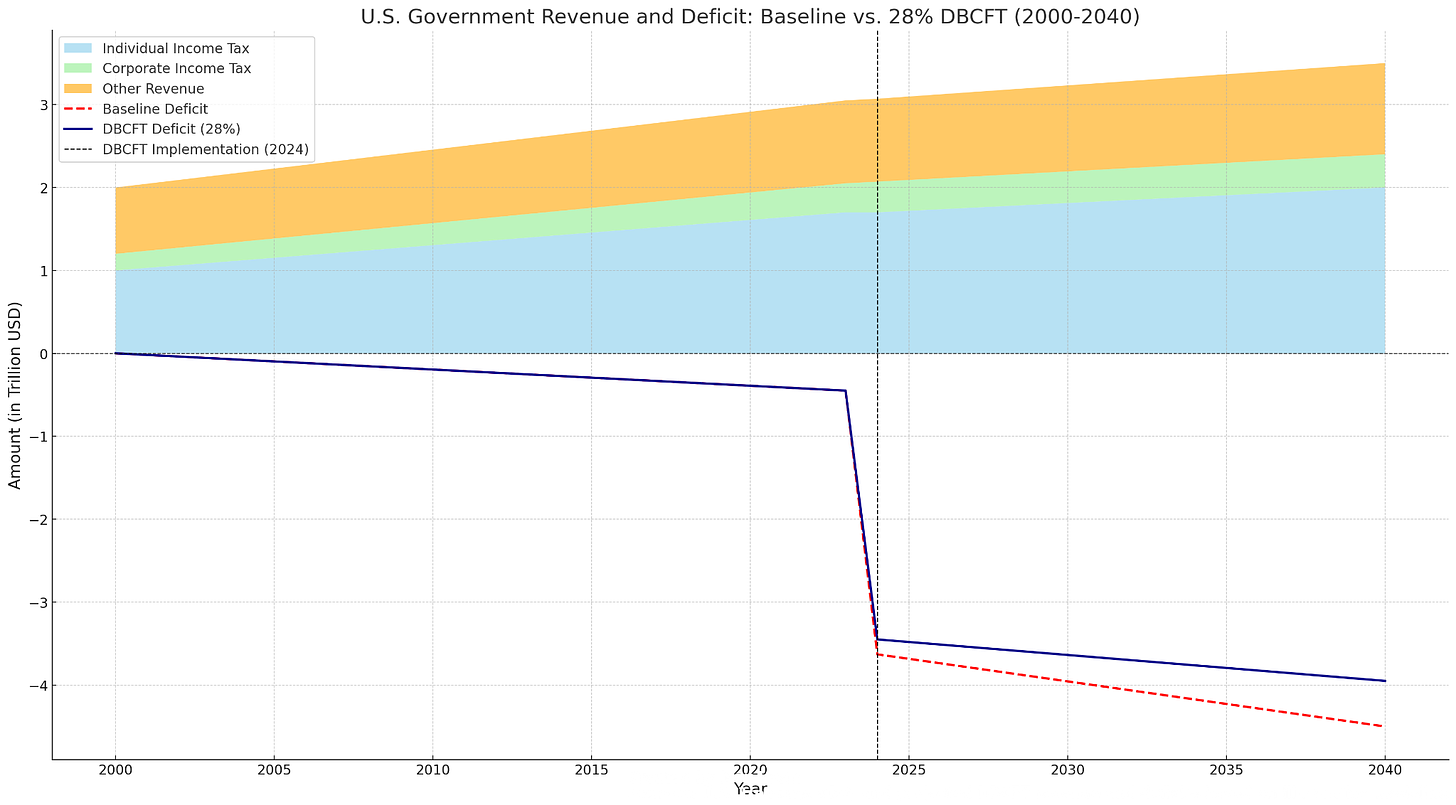

It’s within this context of fiscal urgency and partisan division that the DBCFT emerges as a potentially attractive option. It’s not a panacea, and it faces significant political hurdles, but it offers a unique set of features that could appeal to both sides of the aisle, making it a potential bridge over the troubled waters of the 2025 fiscal cliff. As discussed earlier, the DBCFT has the potential to be a revenue-generating powerhouse. Broadening the tax base, reducing tax avoidance, and stimulating economic growth could generate substantial revenue to help offset the cost of extending some or all of the TCJA’s tax cuts, or to fund other priorities. This could appeal to Democrats who are concerned about the budget deficit and want to ensure that any tax cuts are paid for.

The DBCFT’s border adjustment mechanism, which effectively taxes imports and exempts exports, could appeal to Republicans and Democrats who are concerned about American competitiveness and want to bring manufacturing jobs back to the United States. This feature directly addresses concerns about unfair trade practices, particularly from China, and could be a key selling point for lawmakers from both parties who represent manufacturing-heavy districts.

Both parties can agree that the current tax code is too complex. It is not uncommon for politicians from both parties to campaign on simplifying the tax code, but struggle to make any meaningful changes. The DBCFT’s inherent simplicity could be a major selling point, appealing to lawmakers who are tired of the endless debates over loopholes and deductions. It could also resonate with voters who are frustrated with the complexity of the current system.

The DBCFT’s immediate expensing provision, which allows businesses to deduct the full cost of their investments immediately, is a powerful incentive for investment and economic growth. This could appeal to Republicans who are traditionally supportive of supply-side economics, as well as to Democrats who recognize the need for increased investment in infrastructure, renewable energy, and other key sectors.Despite its potential bipartisan appeal, the DBCFT faces significant political hurdles.

The DBCFT is a relatively new and complex concept, and many lawmakers (and their constituents) may not fully understand how it works. This lack of familiarity can be a major barrier to adoption, as politicians are often wary of supporting policies that are not well understood by the public. The DBCFT would inevitably create winners and losers. Industries that currently benefit from the complex web of deductions and credits in the current tax code are likely to lobby fiercely against it. This includes multinational corporations that engage in profit shifting, as well as businesses that rely heavily on imports. The DBCFT’s border adjustment could be portrayed by opponents as a tax on consumption, which could be politically unpopular, particularly if it leads to even temporary increases in the prices of some consumer goods. This is a messaging challenge that proponents of the DBCFT would need to carefully address.

There are some concerns that the DBCFT’s border adjustment could be challenged as a violation of World Trade Organization (WTO) rules. While many experts believe that a well-designed DBCFT could be structured to comply with WTO rules, the potential for legal challenges could create uncertainty and deter lawmakers from supporting it. Despite these challenges, the 2025 fiscal cliff presents a unique opportunity to enact fundamental tax reform. The expiration of the TCJA provisions forces Congress to act, creating an opening for a broader discussion about the tax system. This is a chance to move beyond the stale partisan debates about simply raising or lowering rates and to consider a more fundamental restructuring of the tax code.

The 2025 fiscal cliff is not just a challenge; it’s an opportunity. It’s a chance for lawmakers to break free from the partisan gridlock and enact bold reforms that will shape the American economy for decades to come. The DBCFT offers a unique path forward, a chance to create a tax system that is simpler, fairer, more efficient, and better equipped to meet the challenges of the 21st century. Enacting the DBCFT would be a legacy-defining achievement for any Congress and any president. It would be a testament to their vision, their courage, and their commitment to putting the long-term interests of the country ahead of short-term political gain. The road ahead will be difficult, but the potential rewards are immense. It is time for our leaders to seize this opportunity and build a brighter economic future for all Americans, and to cement the United States’ place as a global economic leader in a new era of great power competition. The DBCFT is not just a good idea; it is an idea whose time has come.

Let’s stop sitting with our dicks out while Rome burns. Let’s choose growth, security, and a new era of American dominance. Let’s pass a DBCFT, unleash the machete on our regulatory jungle, and forge an economy ready for the challenges and opportunities of the 21st century. America’s economic future, and our place in the world, depends on it. And if we do it right, we might even have a little fun along the way. Because who doesn’t love the smell of burning red tape in the morning? It is the smell of progress, the smell of a brighter future, the smell of a resurgent America, ready to take on the world and win.

Thanks for reading! Subscribe for free to receive new posts and support my work.